New Jersey Estimated Tax Payment Voucher 2024. New jersey income tax calculator 2024. You must make them online at partnership return filing and payment services.

Estimated income tax payment voucher for 2023 : Welcome to the 2024 income tax calculator for new jersey which allows you to calculate income tax due, the effective tax rate and.

Quarterly Estimated Tax Payments For The 2024 Tax Year Are Due April 15, June 17, And.

You must make them online at partnership return filing and payment services.

If You Owe Less Than $1, You Do.

Guidebook to new jersey taxes (2024) a quick reference guide covering the general provisions of the respective tax laws, regulations and administrative rulings useful to tax.

In This Case, You May Need To Make A Payment With Your Return Or At A Later Date.

Images References :

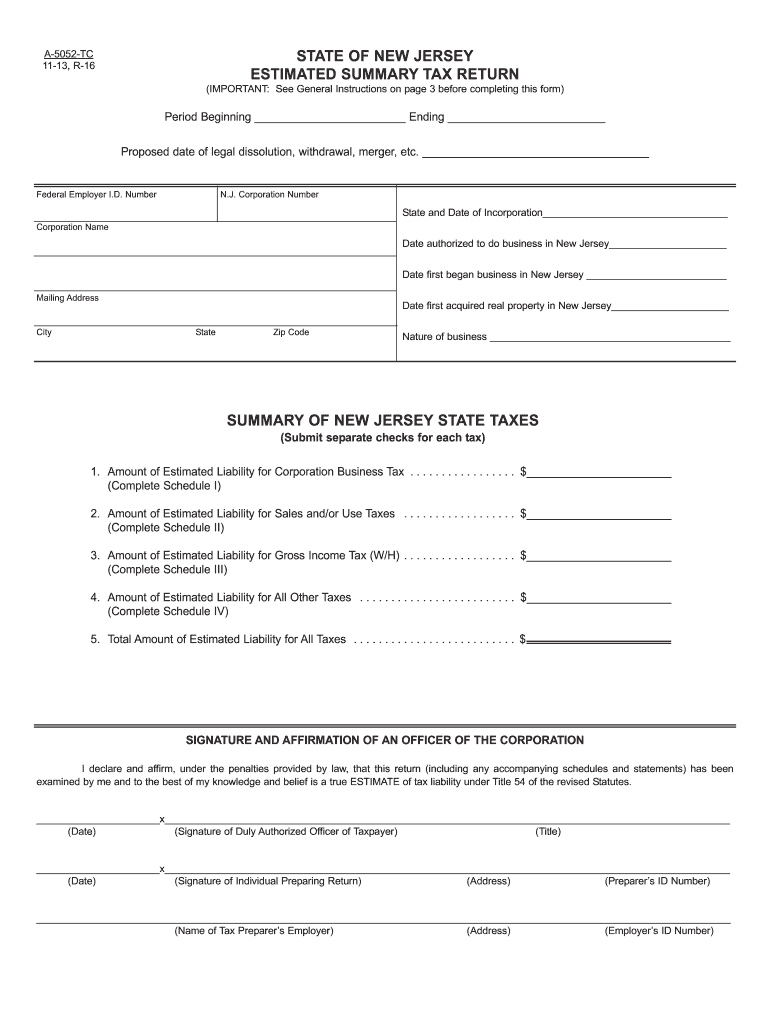

Source: www.dochub.com

Source: www.dochub.com

Nj estimated tax payments Fill out & sign online DocHub, Estimated income tax payment voucher for 2024: If you are paying a balance due for 2023 and also making an estimated tax payment for 2024, make a separate payment for each transaction.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online 2023 Prepayment Voucher, Estimated Tax Fax Email Print, Learn how to calculate your estimated payments. If you owe less than $1, you do.

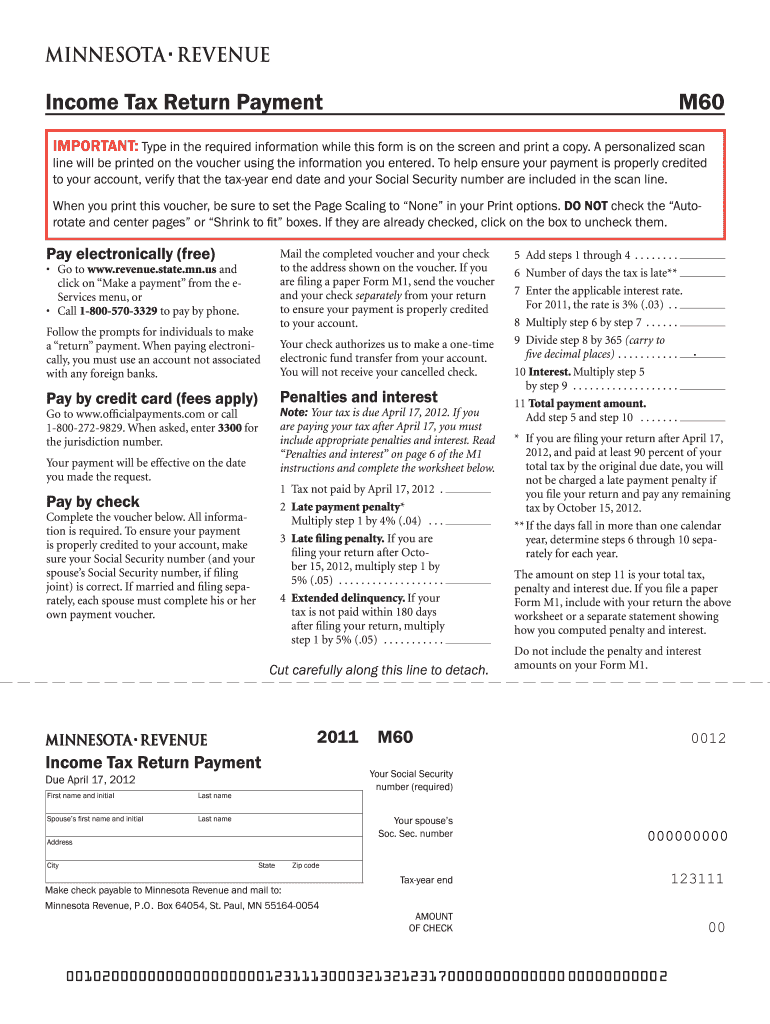

Source: www.dochub.com

Source: www.dochub.com

Minnesota estimated tax voucher 2023 Fill out & sign online DocHub, Pay bills resulting from corrections in senior freeze (property. If you owe less than $1, you do.

Source: annienouran.blogspot.com

Source: annienouran.blogspot.com

Federal estimated tax payments 2021 AnnieNouran, The installment amount is based on the total tax liability shown on the tax return from the previous privileged period. If you owe less than $1, you do.

Source: www.formsbank.com

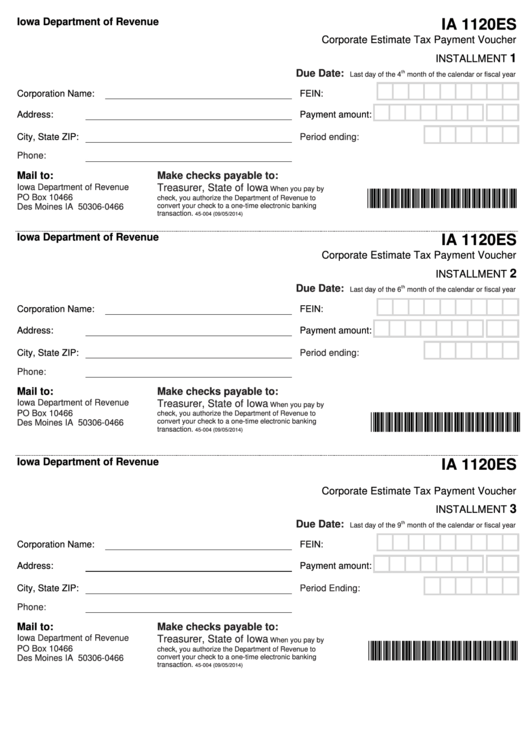

Source: www.formsbank.com

Fillable Form Ia 1120es Corporate Estimate Tax Payment Voucher, The installment amount is based on the total tax liability shown on the tax return from the previous privileged period. If you are paying a balance due for 2023 and also making an estimated tax payment for 2024, make a separate payment for each transaction.

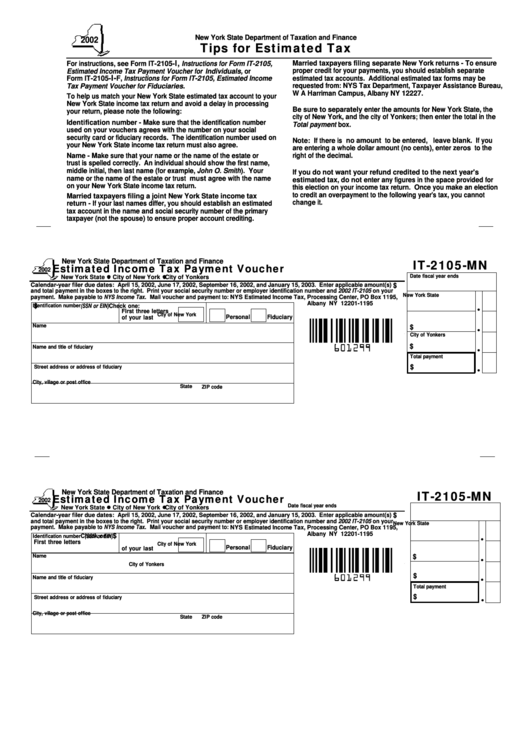

Source: www.formsbank.com

Source: www.formsbank.com

Form It2105Mn Estimated Tax Payment Voucher Form State Of, You must make them online at partnership return filing and payment services. The final payment is due january 2025.

Source: www.dochub.com

Source: www.dochub.com

Kentucky estimated tax voucher 2023 Fill out & sign online DocHub, If you owe less than $1, you do. You must make them online at partnership return filing and payment services.

Source: www.formsbank.com

Source: www.formsbank.com

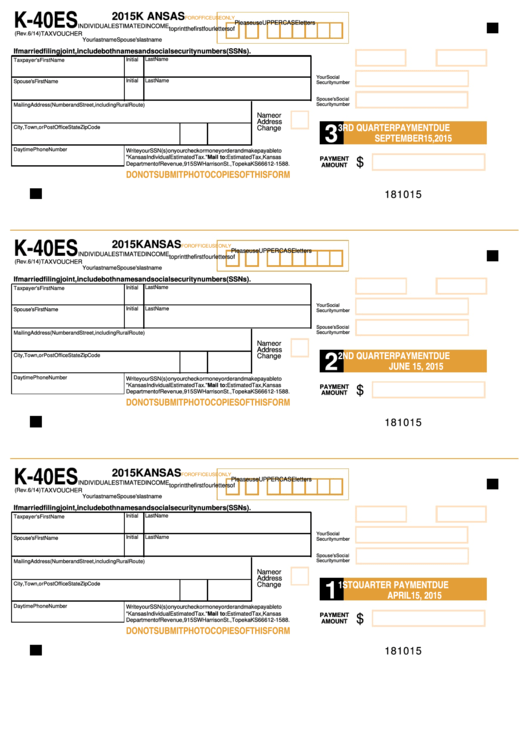

Fillable Form K40es Individual Estimated Tax Voucher, In this case, you may need to make a payment with your return or at a later date. The installment amount is based on the total tax liability shown on the tax return from the previous privileged period.

Source: www.signnow.com

Source: www.signnow.com

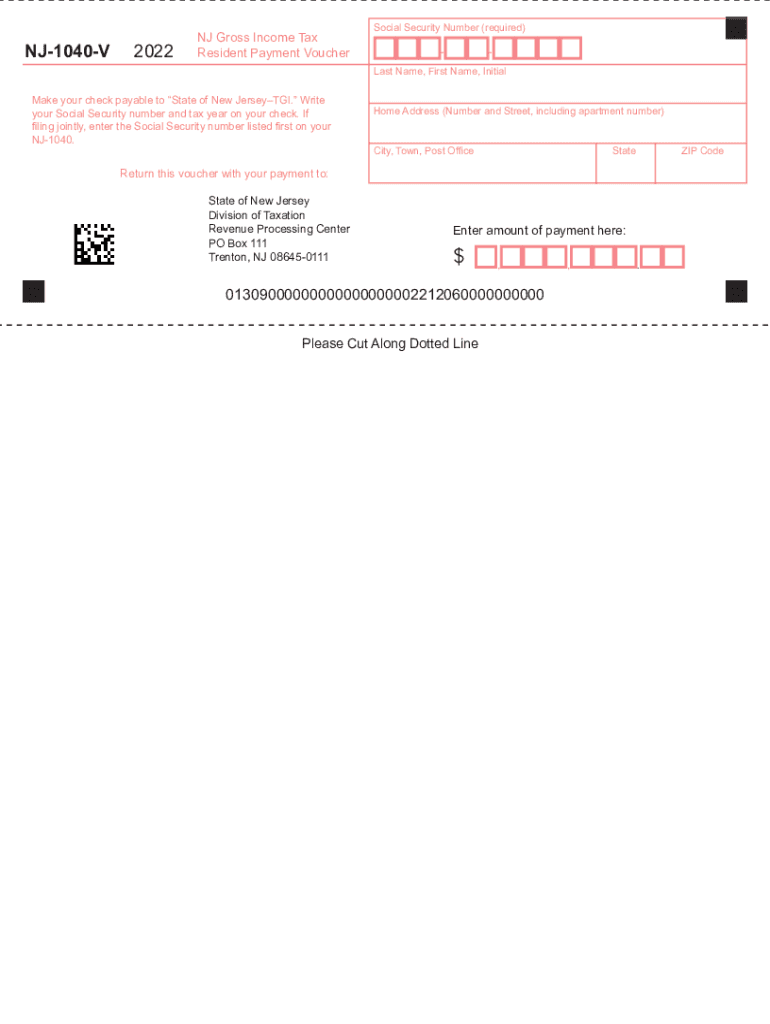

Nj V 20222024 Form Fill Out and Sign Printable PDF Template signNow, For tax year 2024, below is the schedule of vouchers and the due dates for each quarterly payment: Guidebook to new jersey taxes (2024) a quick reference guide covering the general provisions of the respective tax laws, regulations and administrative rulings useful to tax.

Source: www.formsbank.com

Source: www.formsbank.com

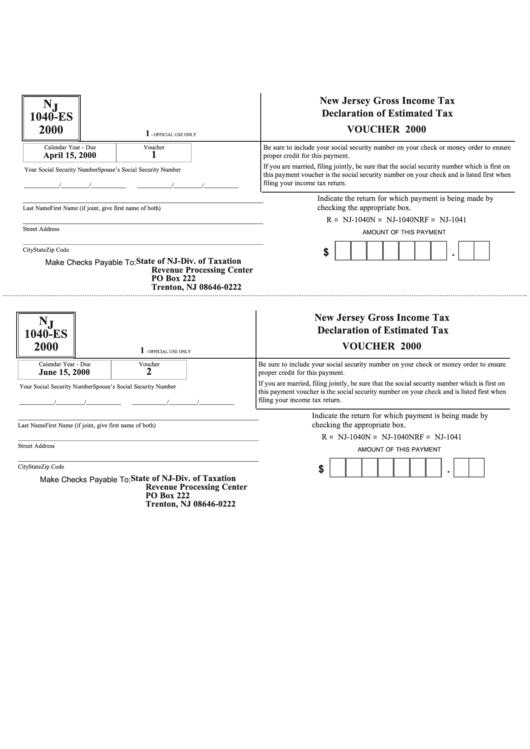

Form Nj 1040Es New Jersey Gross Tax Declaration Of Estimated, Make estimated income tax payments and track your account. Corporations are required to make installment payments of estimated tax.

Estimated Income Tax Payment Instructions:

Quarterly estimated tax payments for the 2024 tax year are due april 15, june 17, and.

If You Are Paying A Balance Due For 2023 And Also Making An Estimated Tax Payment For 2024, Make A Separate Payment For Each Transaction.

Pay senior freeze (property tax reimbursement) bills;