2024 Estimated Tax Payment Voucher Pdf Download. For individuals and corporations, the advance tax is to be paid in four instalments throughout the financial year, which runs from april to march. What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.

What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal. For individuals and corporations, the advance tax is to be paid in four instalments throughout the financial year, which runs from april to march.

2024 Estimated Tax Payment Voucher Pdf Download Images References :

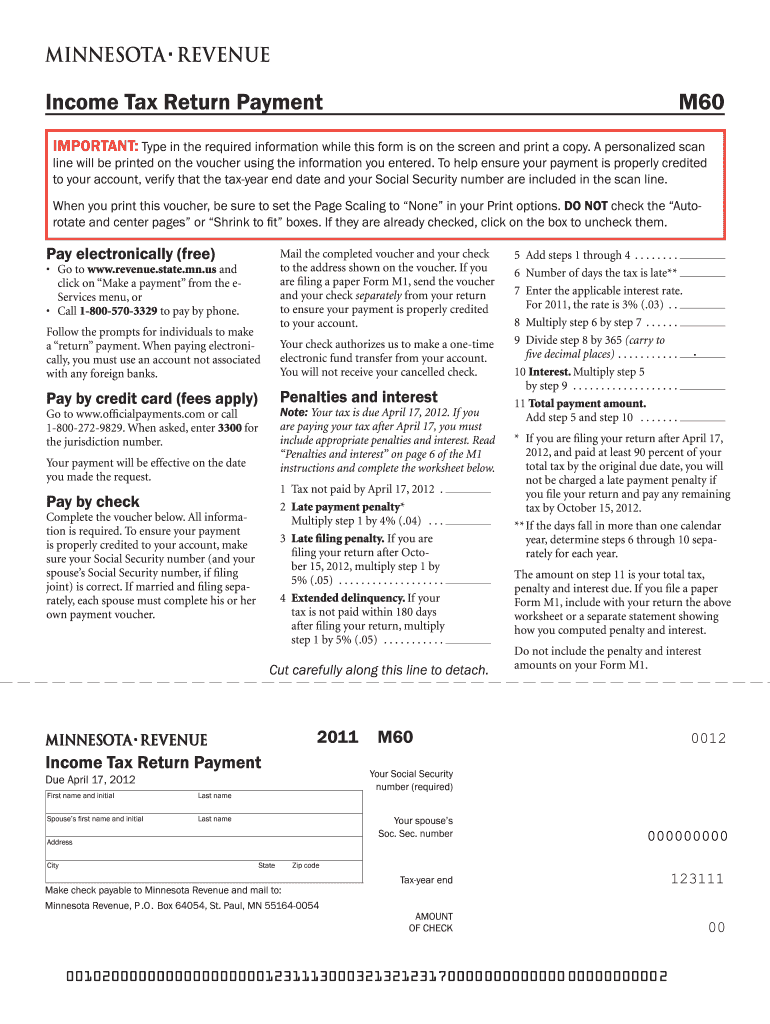

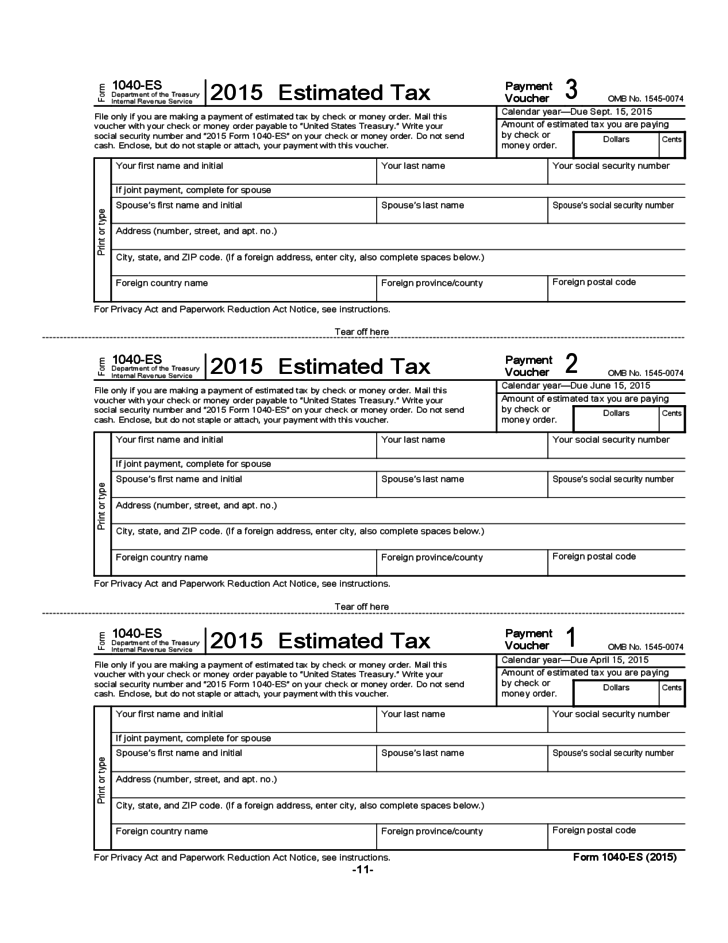

Source: rhetabjeanelle.pages.dev

Source: rhetabjeanelle.pages.dev

Estimated Tax Payments 2024 Forms Vouchers Pdf Download Malia Rozalie, What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.

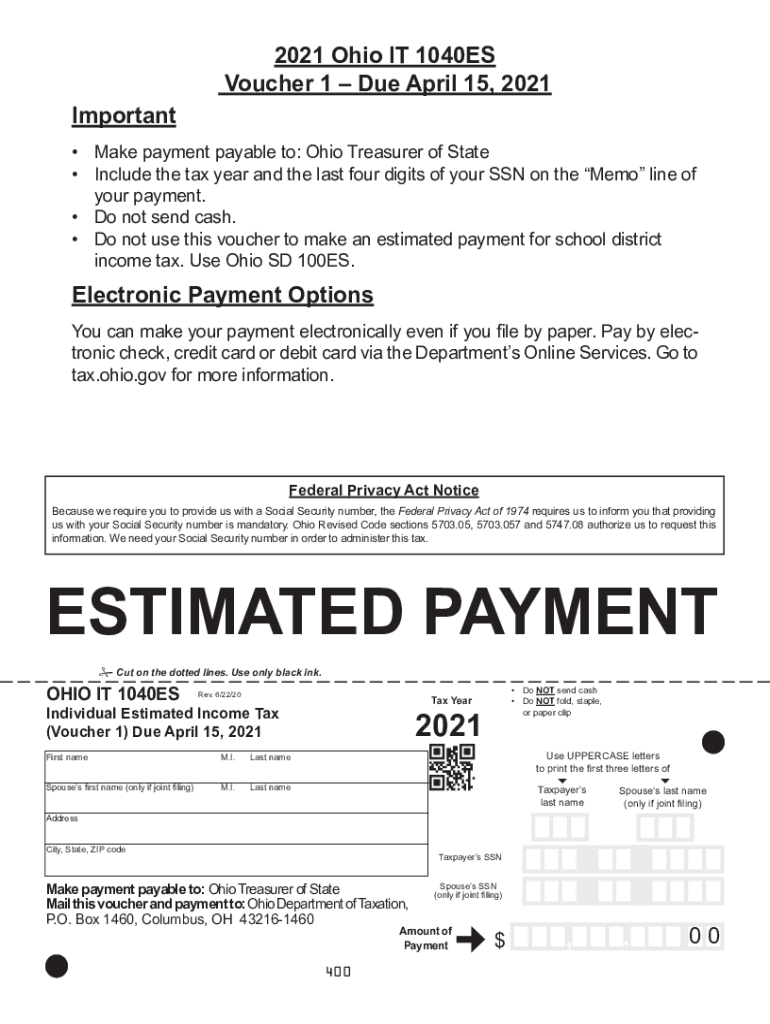

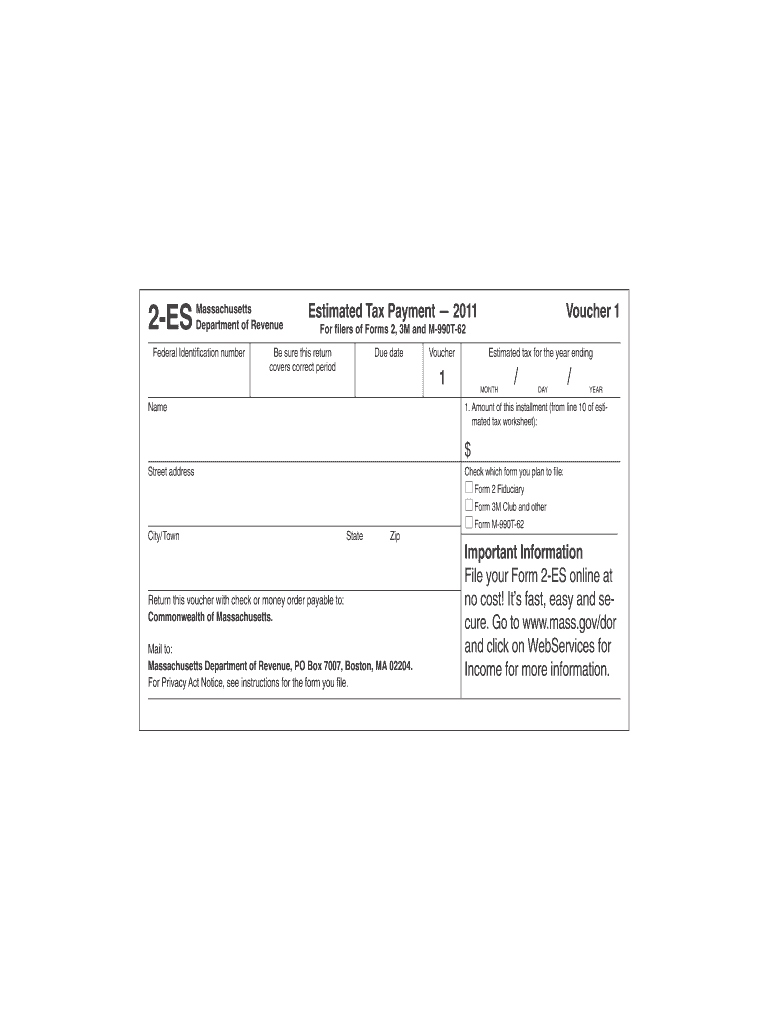

Source: blinnyystacee.pages.dev

Source: blinnyystacee.pages.dev

2024 Es 2024 Estimated Tax Payment Voucher Bevvy Chelsie, For individuals and corporations, the advance tax is to be paid in four instalments throughout the financial year, which runs from april to march.

Source: lorneydoralyn.pages.dev

Source: lorneydoralyn.pages.dev

Estimated Tax Payments 2024 Vouchers In India Lois Sianna, For individuals and corporations, the advance tax is to be paid in four instalments throughout the financial year, which runs from april to march.

Source: ninonbhollyanne.pages.dev

Source: ninonbhollyanne.pages.dev

Irs Estimated Tax Payment Voucher 2024 Wendi Edeline, What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.

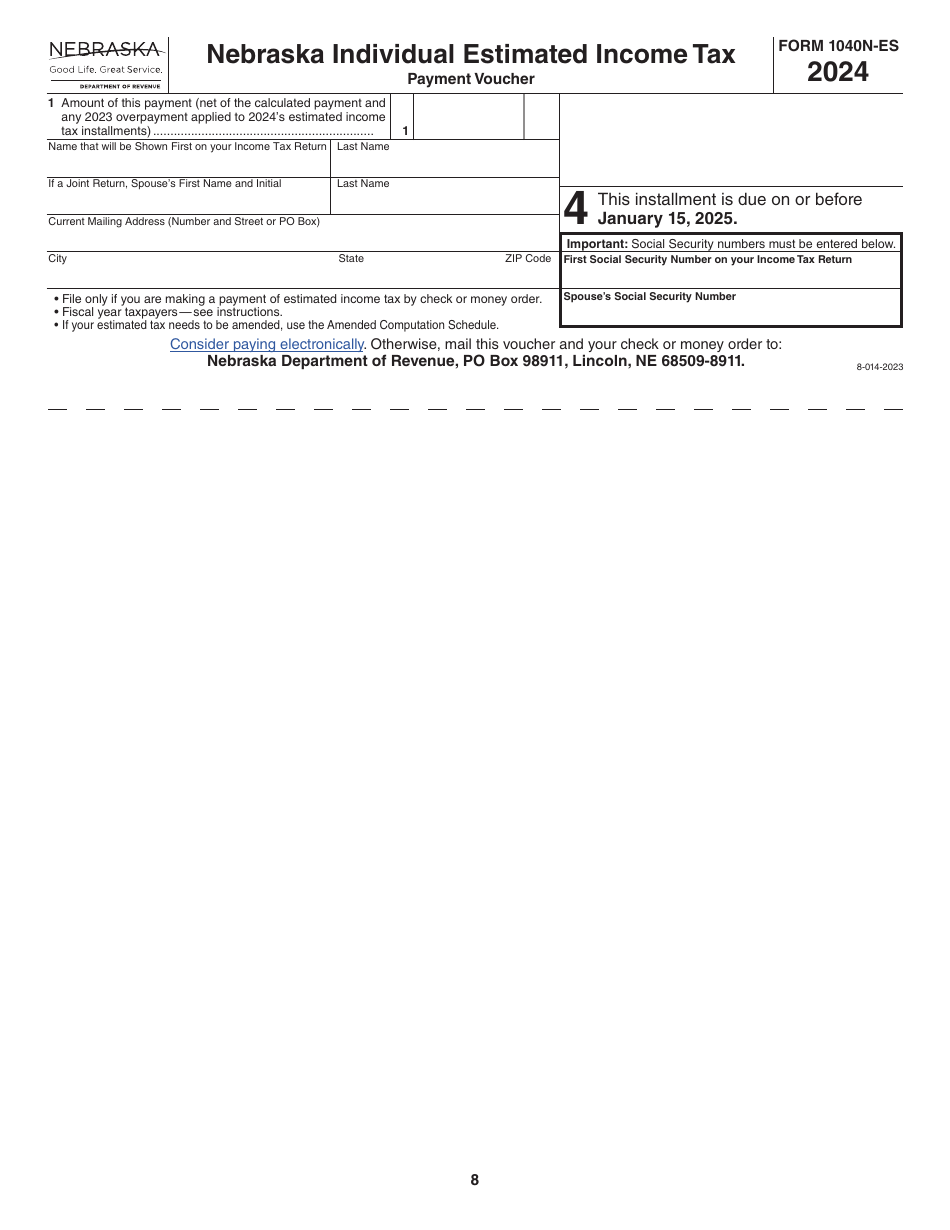

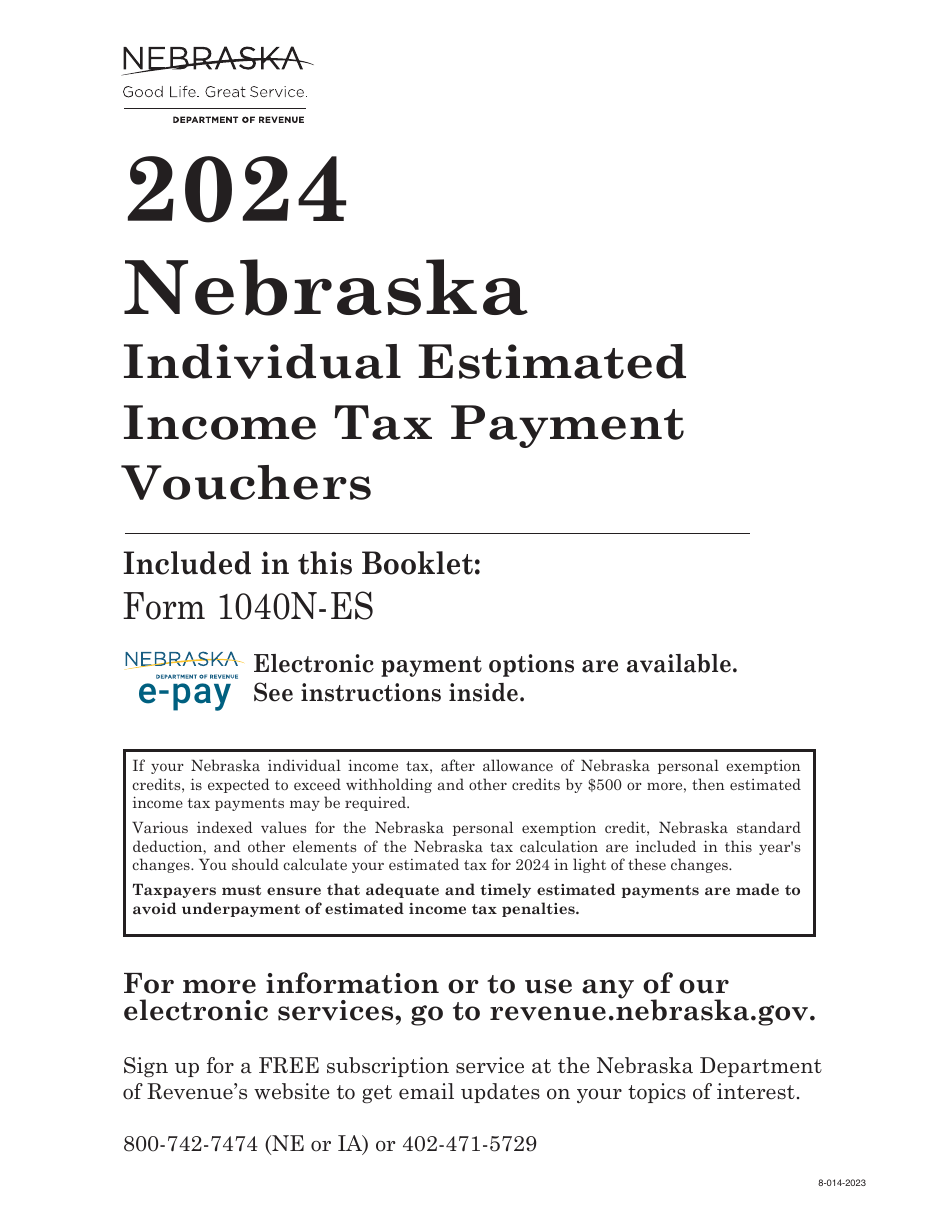

Source: www.templateroller.com

Source: www.templateroller.com

Form 1040NES Download Fillable PDF or Fill Online Nebraska Individual, For individuals and corporations, the advance tax is to be paid in four instalments throughout the financial year, which runs from april to march.

Source: www.templateroller.com

Source: www.templateroller.com

Form 1040NES Download Fillable PDF or Fill Online Nebraska Individual, What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.

Source: cammiycorilla.pages.dev

Source: cammiycorilla.pages.dev

Estimated Tax Payments 2024 Forms Vouchers 2024 Geri Pennie, For individuals and corporations, the advance tax is to be paid in four instalments throughout the financial year, which runs from april to march.

Source: joniypierrette.pages.dev

Source: joniypierrette.pages.dev

Estimated Tax Payments 2024 Forms Vouchers Orel Martina, What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.

Source: alanaqcoraline.pages.dev

Source: alanaqcoraline.pages.dev

Estimated Tax Payments 2024 Forms Vouchers Daron Emelita, What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.

Source: doroteawalleen.pages.dev

Source: doroteawalleen.pages.dev

2024 Es 2024 Estimated Tax Payment Voucher Eloisa Shaylah, What is the penalty for missing advance tax payment penal interest under sections 234b and 234c is applicable for default in payment of advance tax a penal.